Data & AI

Data & AI

Introduction

Artificial Intelligence is hot. Developments in AI have increased exponentially in the recent years and the general public became aware of its strengths. We expect that this development will not flatten quickly in the future, but will only gain more traction. Using Data & AI enables organizations to sharpen their models and get more value from their data. However, it is important that organizations have an effective data strategy. The Data & AI team is ready to help you as an organization with this, by identifying crucial and strategic applications and providing the right solution.

Approach

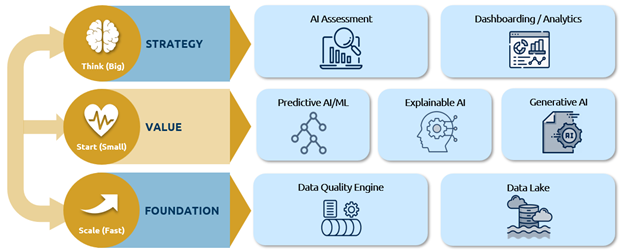

The goal of Data & AI is to deliver value to your organization through an effective data strategy. As a team, we can help within every layer of the organization, depending on the need. In our approach, we can provide solutions on three levels:

- Strategy. As an organization, it is important to make long-term plans for the future of the company. Together with your organization, our team can advise on what the future could look like with a data-driven vision. We can visualize the data in clear and attractive dashboards.

- Value. With the expertise of our Data & AI team, we are able to help your organization with all kinds of different data projects, such as providing insights into risk management or customer experiences. We can be deployed as a total solution for delivering data analyses, creating (explainable) Machine Learning models or deploying the developed models to production.

- Foundation. In order to extract value from your data, it is essential that this data is available, complete and clear. Data & AI helps you set up data platforms where all data can be centralized. Within a data platform, we can provide you with data quality controls and data management. By using these tools, the organization will be fully in control and have access to the best available data.

Successful with Data & AI

Triple A’s Data & AI experts have both financial and actuarial domain knowledge, as well as the practical experience to successfully apply Data & AI. We can contribute to a wide variety of business processes, both inside and outside the financial sector. We are happy to help deliver data-driven solutions!

Claims Management

As an insurer, you want better returns from your portfolio and you are looking beyond just the pricing. After all, competition in the insurance market is increasing, putting pressure on your premiums and profitability.

Premiums for Non-life Insurers

The non-life insurance market is shrinking and domestic and foreign competition is increasing. As a result, setting the premiums for your insurance products is crucial to stay in the race.

Continuous Improvement Data Driven

Our Data Driven Continuous Improvement proposition helps you make strategic decisions based on data-driven insights. This allows you to more efficiently optimise and organise all processes in your value chain

scenarios that are forward-looking

Our unique forward-looking scenarios enable clients to develop a long-term vision based on realistic data.-

-

More information or a conversation with us?

Please contact Pieter Stel

© 2025 AAA Riskfinance. All rights reserved.